White Paper - Build vs Buy (Part I - Cost)

Companies struggle with the idea of build versus buy all the time. Sometimes, the correct answer is abundantly obvious. Very few firms would choose to try to build their own phone systems or perform their own electrical work. However, when it comes to other types of systems, such as Commercial Real Estate Systems, firms consider doing exactly that.

This white paper explores what a reasonable cost to build and maintain a Commercial Real Estate System would be and thereby whether it makes more sense to build internally or buy an already built external system.

The Assumptions

It will be necessary to set some base assumptions for the purpose of this analysis. These are not meant to be accurate but instead meant to reflect the absolute best case (in terms of self-building). The theory is that by assuming the best case it eliminates the "Oh but we're better than that” argument that inevitably will arise from internal groups which feel territorial about system development and/or think it will give themselves job security or political clout. The assumptions are as follows:

-

The development team is extremely talented and has all the key components without which these projects tend to fail.

-

Significant commercial real estate knowledge in the actual team (ie experience in CRE SaaS systems)

-

Unfettered access to business users/SMEs (Subject Matter Experts) for questions

-

Substantial technology knowledge & proficiency

-

No internal politics which would interfere with the project

-

No loss of team members during the entirety of the project (2-3 years minimum)

-

Heavy involvement by business users for requirements for potentially hundreds of pages (screens, reports, models)

-

Unflinching support from upper management to continue to put money into the project & not to redirect team focus

-

It should be noted just how rarely this convergence of factors occurs. Distractions, politics, employee retention, and lack of integrated knowledge of both real estate and technology are frequently at fault for massively greater costs than the ones included below. These costs can lead to a multiple of cost – i.e. 200%, 300%, 400% increases - or more likely total project failure somewhere after 100% of estimated cost, i.e.. Where a firm spends 100% of the below amount and then closes down the project with absolutely nothing to show for it.

The final assumption is regarding costs:

- Each project team member in this project will receive $100/hour as total compensation. This is highly unrealistic given the highly talented, experienced, and focused people which have been assumed above and especially inclusive of other extras (benefits, other compensation, computers, and office space, etc.) and the need to retain all the members of the team (since otherwise all their system knowledge leaves with them). Despite this, we will use this assumption so as not to provide for the argument that the hourly rate artificially inflated the estimates. A firm should ratio their cost against the above number and factor in today's highly competitive tech & business environment.

The final assumption is that this analysis is strictly the monetary costs involved in the project. This will not cover the true cost of putting the best people in an organization on a project that will take years before it reaches final completion, thereby depriving the organization of these skilled employees on other projects which are more likely to be revenue-producing. This opportunity cost analysis will be covered in a separate white paper.

The cost of a system can be broken into 3 components

- Cost to Initially Develop (One Time Fixed Cost)

- Cost of Ongoing Development (Ongoing Yearly Cost)

- Cost to Maintain Infrastructure (Ongoing Yearly Cost)

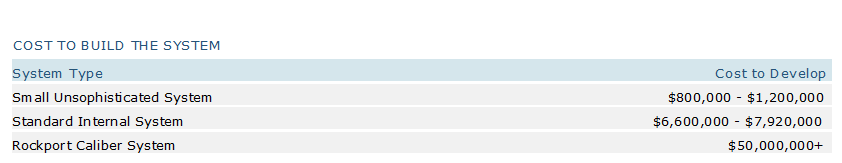

Cost #1 – Cost to Initially Develop

Internal development costs vary widely depending on the scope of the system and the company's threshold for errors or poor system performance. Traditionally internal systems tolerate these defects as they simply do not have the capacity or willingness to spend the time and money to fix them (features take precedence). Third-Party systems have the advantage of a much larger budget base and willingness to spend the money necessary since the system is a revenue center for a third-party system.

We will look at two basic scenarios, as well as Rockport's own experience on what a reasonable cost assumption would be.

Basic, Super Trimmed Down System:

-

Small, 100-200 Fields (most modern firms track 500-1000 data points).

-

~20 Total Screen & Reports

-

No Advanced Features (Audit Logs, Integrations with Data Vendors or Third Party Servicers, AI or other Providers, etc)

-

No Integrated Excel Underwriting Model (this is an extraordinarily expensive feature to build)

-

No Advanced Modeling Abilities (e.g. lease rollover modeling)

-

No Integrated Ad Hoc Reporting, probably limited to exporting data nightly and using commercially available offline reporting tools.

-

Fairly clunky user interface due to no UI/UX specialization on the team.

-

Limited Security Features (potentially non-viable in today’s climate; mitigated by being a non-web, internally accessible application)

-

Complex Debt Structures,

-

Multi-Property Loans,

-

Different Property Types w/ different Chart of Accounts & Detailed Expense Line Items

-

Support of a Limited number of Loan Types (e.g. Conduit), with no ability to allow the business to expand in new directions

-

Time Series Analysis of All Data

-

- Users tend to be unhappy due to limited functionality.

Members of Rockport have built these systems in previous jobs and are well-versed in the efforts required. Additionally, we have spoken with many clients when they choose Rockport to replace these type systems. This type of system probably takes a MINIMUM 8,000-12,000 person-hours to build (Project Management, Technology Selection, Requirements, Database Design, Development, Testing, User Training, Security Reviews, DR setup, etc.).

Based on our assumptions this means a cost of initial development of $800,000 - $1,200,000. To reiterate, this is a baseline assuming ALL of the aggressive assumptions on page 1 AND is based on $100/hour for resourcing (also unlikely in today's environment).

Classic Internal System (Attempts to be a Relatively Sophisticated System)

This type of system has acceptable levels of disaster recovery, probably is built on AWS, typically only includes a few (maybe 30%) of the many sophisticated features available in an enterprise-caliber system (e.g. Audit Trail, Integrated Excel Underwriting Model, Advanced Report Generation, Ad Hoc Reporting for the end-user, etc.)

This system will not have any sophisticated interactions with outside third-party systems as third-party systems have a significant aversion to interfacing on a custom basis (all cost, almost no benefit). On the rare cases that they do, they will charge large integration fees (probably $200 - $500/hr for resources).

This type of system requires a dedicated sizable project team for multiple years to design, build and test. Absolute minimum team required for two years would probably be:

- 1 Product Owner who doubles as a Project Manager

- 2 SMEs (Subject Matter Experts)

- 2 Requirements Analysts

- 2 Experienced QA Engineers

- 5 Developers (1 Architect, 4 Senior Developers/Database Designers)

Unfortunately, at the end of this time, the system would probably be fairly hardcoded (not flexible to changes in market) and have relatively little focus on user-friendliness. There also is a significant risk that the design was not perfect, because it came out of the heads of 2 to 3 people, without the benefit of a market feedback loop that commercial SaaS firms receive.

Based on our assumptions this means a cost of $5,280,000. Although, it would certainly not be out of the ordinary for a project like this to slide into an extra year. If this occurs, the cost would rise to $7,920,000. For the purpose of this analysis, we will average these two outcomes ($7,260,000). To reiterate, this is a baseline assuming ALL of the aggressive assumptions on page 1 AND is based on $100/hour for resourcing (also unlikely in today's environment).

Rockport Caliber Internal Systems (i.e. Enterprise Class)

These kinds of systems are unfathomably expensive for the normal reader to comprehend.

For simplicity, we will provide a comparable analysis. The names have been omitted to protect the privacy of the people involved. These plus data points from our own experience building one of these systems and also speaking with our customers and other industry participants is that these systems cost a MINIMUM of $50 million to develop to full fruition. Worse, these projects also have a roughly 50% chance of failure post expenditure of the money. This means that in reality, the cost rises to approximately $100 million on a risk-adjusted basis.

-

Unnamed SaaS System 1: ~$50 million invested. Result: Out of Business. IP sold for a penny or two on the dollar.

-

Unnamed SaaS System 2: ~$65 million invested. Result: Out of Business. IP sold for a penny or two on the dollar.

-

Unnamed Financial Firm 1: Two firms merged; combined systems had cost ~$50-$75 million. Bank decided to use a 3rd party system instead and closed down both internal projects.

-

Unnamed Financial Firm 3: Tried building internally for 5 years w/ large team. Stopped Effort & went with Rockport.

The above is only a few of the many case studies we have seen. To be clear all the above systems were staffed with highly talented, deeply experienced personnel, who were extremely motivated and tried to succeed.

System development is not at all simple and is NEVER cheap.

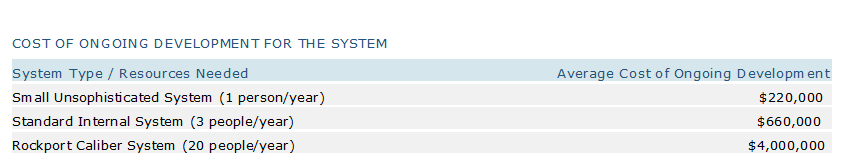

Cost #2 – Cost of Ongoing Development (Yearly Costs)

The cost of incremental improvements is variable, based on the company and its ability to live with old systems and the complexity of its business model. The following estimates are based on what we have observed as the ongoing incremental support/upkeep costs to maintain the systems, make necessary improvements, and keep pace with the changing market. Firms with complex business models (multiple lending products, asset management functions, regulatory obligations) should estimate higher.

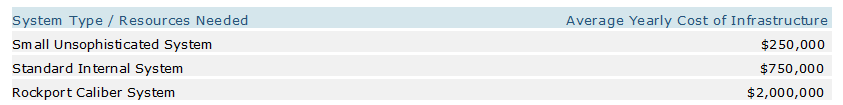

Cost #3 – Cost to Maintain Infrastructure (Yearly Costs)

Infrastructure costs are often ignored during the decision-making period. Infrastructure costs should not be ignored as they can have a significant impact on overall project cost. This cost includes infrastructure cost (e.g AWS) and the personnel to support it, maintaining and testing disaster recovery and data backup, penetration testing, ongoing proactive security & responding in real-time to newly discovered vulnerabilities in common products, and software licensing.

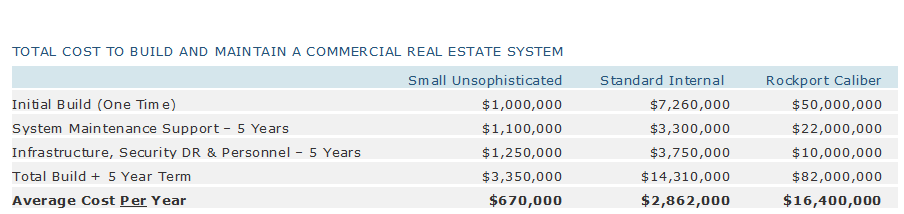

Conclusions

In conclusion, the combination costs (assuming a 5 year period) are as follows.

NOTE: In general technology becomes obsolete over a 5-7 year hold period, so a substantial portion (30-50%) of the initial invested amount will be required to renovate the system in Year 6.

Reminder: The above reflect the MINIMUM potential cost. Expected Costs are higher. Risk-Adjusted Costs are even higher (50%+ of projects fail). Opportunity Cost of distraction from a client’s core business, thereby diminishing focus on revenue-producing activities is EVEN HIGHER.

The conclusion drawn from this study can only be: Rockport represents an enormous bargain when compared to the cost to build even the most basic of systems.

If you're interested to learn more, take a couple of minutes to watch this interview I recently did talking about the advantages of SaaS:

Posted by Will Trepp

Will Trepp is the Co-Founder & COO of The Rockport Group, where he leads SaaS solutions managing over $1.5T in CRE assets. With a background in Computer Science and CRE finance, he focuses on the intersection of technology, real estate, and data.